Explaining Current Events

A PRIMER ON THE FEDERAL BUDGET

There’s a lot of talk these days about cutting “wasteful government spending” and making the “hard choices” for balancing our nation’s budget. There’s good reason for this. Currently, the United States is running a $1.8 trillion (with a T) deficit. The President Elect has chosen two successful entrepreneurs to form a commission to help get our fiscal house in order.1 It seems obvious that we have a problem when our government is consistently spending more money than it is taking in.

Yeah! What gives with this? Why can’t the government just live within its means?

Well, it’s not quite that easy. Think about your own budget. You go to work, you get paid. You have expenses and, as a responsible person, you endeavor to keep your expenses lower than the amount you get paid. Maybe you are doing a great job of this…then your car breaks down, or your pet gets sick, or your favorite cousin is getting married. Unplanned expenses can wreck any well planned budget. And you’re just one person!

Now imagine the budget for the entire United States! We are the third largest nation in terms of population with over 340 million people. I know! Right? Ours is the fourth largest nation by land area, encompassing a huge central region on the North American continent between the world’s largest oceans. We can plan a balanced budget, but there is a really good chance that there will be some unforeseen expenses. California will catch fire. Florida will get hit with hurricanes. A drought might impact our farming. This is why the United States rarely enjoys a balanced budget at the end of every fiscal year.

We also have a leadership role in the world, necessitating spending outside of our country. This is a hotly contested truth. Whether or not we should spend money to help other countries is and always has been a matter of debate. As it stands, however, the answer is yes. The United States leadership is intent on maintaining a leadership role in world affairs. That means spending money outside of our borders on non-Americans. In the future, we may decide not to do that anymore. In that case, we will surrender our leadership role. But that’s a post for another day.

Okay. I get it. But we should be able to do better than this. Clearly, we need to cut spending!

Maybe. Let’s take a closer look.

First, let’s review an economic concept that is going to be very important to this discussion. Opportunity Cost. An opportunity cost is a benefit that is lost upon choosing an alternate opportunity. Budgets are all about opportunity cost. If you spend your money taking Lucy out for pizza, that’s money you don’t have for Game Night with your friends. That’s your opportunity cost. We choose one opportunity, pizza with Lucy, over the other opportunity, Game Night, because we value the one over the other.

Consequently, a lot of the debate about balancing the federal budget has to do with values. It’s not strictly objective.

Got it.

A budget consists of revenues and expenses. Revenues are the money that you get. Expenses is what you spend. A balanced budget happens when your revenues are enough to cover your expenses. If you have more revenues than expenses, you have a surplus. More expenses than revenues, you have a deficit. When you borrow to satisfy your deficit, which the United States does, that is debt. The more your nation falls into a deficit, the higher your debt.

So, balancing the budget requires some combination of two strategies. First, you can raise revenue. Raising revenue happens in two ways. There’s a way we all like, and a way we don’t like so much. The way we like is when revenue increases because the economy is growing. As the economy grows people and firms make more money, and that means they are paying more in taxes even though their tax responsibilities have not increased.

Since the late sixties, however, economic growth has hovered around 2-3%. In most years, our deficits have been significantly higher than that. Economic growth is typically not enough to balance the federal budget.

The second, and least popular way to raise revenue is by raising taxes.

I HATE TAXES!

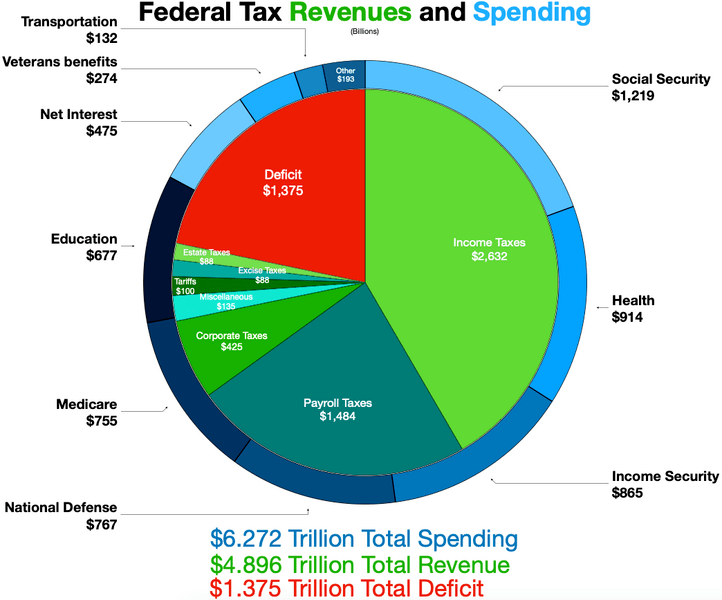

Of course you do. Everybody does. But taxes are the dues we pay to live in a decent society. Without taxes, there are no roads, bridges, ports, schools, police, firefighters. I mean, I guess private firms might fund these things, but they would charge you for the use. Imagine if you had to pay a fee to a private firm every time you turned on to a privately owned road. It would be immeasurably more expensive than what you pay in taxes. Also, all that travel to your local store via roads would be more expensive. Taxes are unpleasant, but if we want the stuff that government provides, someone has to pay. The question is who, and how much. Take a look at Figure 1.

The inner circle is total revenue. It gives you a good rundown of who is paying what. Who’s paying? Mostly you.

Me? What the hell!

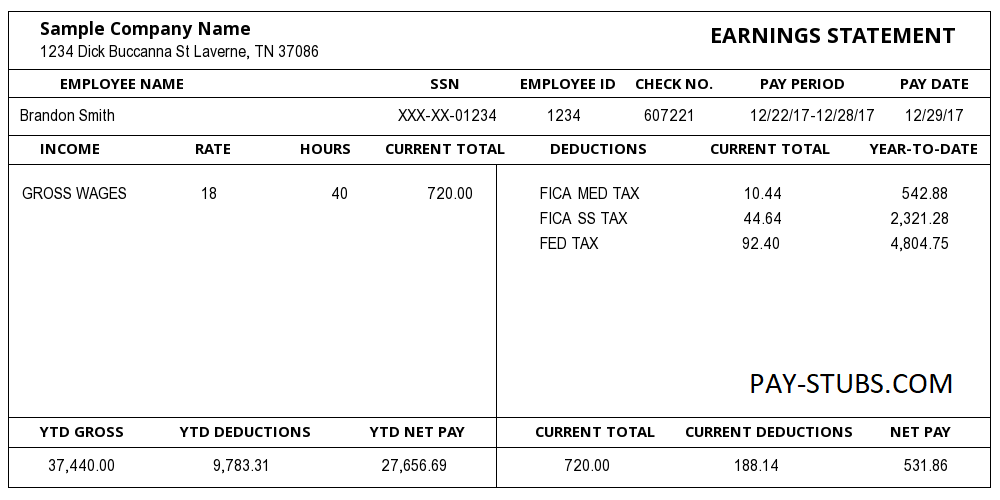

By “you” I mean average people working for a living. Most of all federal revenue comes from the paychecks of working people. Take a look. The largest wedge is Income Tax. Take a look at your pay stub (Fig 2). Where it says Fed W/H, or Fed Tax, that’s how much is coming out of your paycheck every period for Income Taxes.

The second biggest wedge is marked “Payroll Taxes”. On your pay stub, you can find that in the row designated FICA, usually FICA SS and FICA Med. FICA stands for Federal Insurance Contributions Act. This is how much you are paying into Social Security and Medicare. The good news is, you’ll start getting that money back at some point. All you have to do is not die before your reach the qualifying age (67 for Social Security, 65 for Medicare.2 Now FICA taxes are split between you and your boss. The company you work for matches what you pay to Social Security and Medicare.

The third largest is Corporate Taxes. This is the taxes that corporations pay on their profits. You might have noticed that it is way smaller than Income or Payroll taxes. Some advocates, mostly on the left of the political spectrum, suggest that increasing corporate taxes is a great way to increase revenue. Critics contend that burdening corporations with higher taxes will slow economic growth and increase unemployment. The current President Elect believes that increasing tariffs, taxes paid on imports or exports, will raise enough revenue to balance the budget. Critics point out that raising tariffs will increase the prices of goods subject to the tax, and thus slow economic growth.

Regardless, what you are looking at is an opportunity cost. For the record, the last time a budget was decided upon by Congress was the 2017 Tax Cuts and Jobs Act. In that year Congress approved a massive tax cut, most of which went to higher earners and corporations. Advocates for the law believed that cutting taxes would increase economic growth, and thus increase revenues. Critics believed it would significantly increase the deficit. The critics were right. So, might one strategy simply be eliminating the Tax Cuts and Jobs Act and returning to the tax rates we had in 2016?

I HATE TAXES!

Right. Moving on.

The next strategy is cutting spending. Again, this is an opportunity cost. Cutting spending means that the government is doing less stuff. Remember, one person’s spending is another person’s income. Someone will be paying the costs of cutting government spending. Is it worth it?

Again, take a look at Figure 1. The blue ring represents expenditures. Nobel Prize winning economist Paul Krugman liked to point out that, on paper, the United States Government looks like an insurance company with an army. A big chunk of what the government spends money on is Social Security, Medicare, Medicaid and Health Care (which includes subsidies to the Affordable Care Act and CHIP, the Children’s Health Insurance Program).

Furthermore, much of this is what is called Mandatory Spending. In other words, it is spending that has already been defined by law. For instance, those who receive Social Security receive the amount that was determined using a formula approved by Congress. By law, the government must spend that much money.

Spending that is not defined by law is called Discretionary Spending. In other words, Congress decides how much it wants to spend on a particular thing every time it comes up with a budget. Discretionary Spending is the easiest to cut because it does not require changing any specific laws.3 The largest chunk of Discretionary Spending in the U.S. budget is the for military, or the Department of Defense.

Okay. So, what gets cut?

Whatayamean?

Well, looking at the size of the deficit, and the fact that you hate taxes, some significant cuts have to made. Social Security, Medicaid, and Medicare are non-discretionary. The Net Interest is the amount that we pay on our debt. We can’t touch that because then our bond holders will not get paid…that will cause a lot of problems. (I’ll do another post on our debt) So, that leaves mostly Defense spending, Health, including CHIP and ACA, Income Security like food stamps (SNAP), Temporary Assistance to Needy Families (TANF), Housing, etc., Transportation, and a host of other spending items like Education, Foreign Aid, Research. These latter categories could all be cut and not even put a dent in our deficit.

Also, our politicians are not going to cut Defense Spending. We almost never cut defense spending. In fact, as of this post, Congress just sent the most recent National Defense Authorization Act to the President for signature. It was a 1% INCREASE in defense spending at almost $900 Billion.4 Military spending is Discretionary, but…really, it’s not.

Musk and Ramaswamy, the leaders of the Department of Government Efficiency would like to completely eliminate the Department of Education. That would shave just over $240 billion from our deficit (assuming that the savings would be applied to the deficit and not some other endeavor like a massive police force for deporting undocumented immigrants). We’ll still have $1.5 trillion dollars to go, but it’s a start. Oh, most of the money the DoE gets goes to Federal Student Aid, about $160 billion. Hope you weren’t needing that. Someone’s got to pay.

So, who gets cut?

What about all this wasteful government spending I hear about? Let’s start by cutting that.

Yeah. That’s always the go-to for politicians who want to cut spending, but don’t want to piss off their constituents by saying, “I’m going to cut the services you rely on.” Instead, they bemoan the notorious “wasteful government spending” that everyone knows, knows, knows, is an epidemic in government. Certainly, the Federal Government is a huge structure of interlocking agencies spending trillions of dollars. If you look hard enough, you’ll find examples of waste. The problem is that the government is not quite as wasteful as we think, or in the ways we think.

Discourse on government waste takes two forms. The first is the “I Can’t Believe…” category. In other words, “I can’t believe the government spent that much on a hammer.” Every year, watchdogs come up with a list of ridiculous things on which the government spent money. It’s shocking. The problem is, if you add up how much money was “wasted,” it barely scratches the surface of what we need to balance the budget.

Furthermore, when you look more deeply into the examples, you find that the spending wasn’t nearly as wasteful as it seemed. For instance, when the government spent $2.5 million to run an add during Superbowl for the Census, they were criticized for wasteful spending of taxpayer dollars. The Census Bureau, pointed out that every household that turned in their census form was one fewer households the agency had to pay workers to visit and interview. They estimated that a 1% increase in submitted census forms equated to the government saving $85 million. Well worth the $2.5 million they spent.

Other examples of outrageous government spending are just misinterpretations of the budget. For instance, back in the nineties we could not believe that the government would spend $600 on a hammer.5 It was so outrageous that Vice President Al Gore actually created a parody “Hammer Award” for recognizing improvements in government efficiency.

If you couldn’t believe the government would spend that much on a hammer…you would have been right. The government only spent $15 on the hammer. It was an accounting practice that made it look like the hammer cost $435 as it was incorporated into a package of more expensive parts that was then averaged out individually, making the hammer look more expensive than it really was. Meanwhile, looking at the same spreadsheet, other more expensive items, like engines, would have appeared much cheaper than they actually were. Professor Steven Kelman rightly pointed out, “but nobody ever said, ‘What a great deal the government got on the engine!'” Of course not. Stories of government waste validate our presumptions, and are therefore more likely to be reported.

The second form is spending on “Those Things.” Spending on Those Things refers to government spending that I don’t like, but might be a benefit for someone else. Obviously, as a teacher, I don’t want the DoE to be cut. But I might not have a problem with cutting subsidies to the Alaska Department of Transportation. This kind of critique is usually thrown at means tested programs6 like Temporary Assistance for Needy Families, and the Supplemental Nutrition Assistance Program. If you don’t use the programs you might have a bias against spending money on them. Especially when you hear exceptional stories about how individuals abuse the system, like Ronald Reagan’s infamous Welfare Queen.7 The problem is that research has identified very little actual waste in these programs. Certainly not enough to eliminate our deficit.

Furthermore, government health programs are the biggest chunk of the fiscal pie, but are often much more efficient than market-based health care programs. This is a problem for proponents of privatizing American health care to cut the deficit. Perhaps your taxes will go down, but your premiums will certainly go up.

That’s not to say that there isn’t any wasteful spending in the government. In fact, the Government Accountability Office (GAO) has full-time people looking into just that. All government agencies are subject to GAO audits every year. Every year, almost all government agencies pass their audits.

Which agency has the worst track record when it comes to internal audits?

If you said the Department of Defense, you are correct. The DoD routinely fails its audits…without consequence. Again, we just gave them a raise. The last failed audit revealed that the Pentagon could not account for over 60% of its $3.5 trillion assets.

But we don’t cut defense because we don’t cut defense.

Even if we cut defense spending entirely, that only gets us half way to a balanced budget. There’s just not enough waste to go around. Even if it were possible to cut all of the wasteful spending from such a huge bureaucracy, we still would not balance the budget.

The bottom line is that balancing the budget will be costly. If balancing the budget is important, then it must be decided how these costs are shared throughout the nation. Balancing the budget will require some combination of raising taxes and cutting spending. There is no other way. The question is, whose taxes get raised, and whose government benefits are cut.

We also have to realize that the government is a huge actor on the national economy. Raising taxes and cutting spending means slowing economic growth…at least a little bit. Cutting spending, for instance means that people who work for the government, or are working under government contracts, are likely to lose their jobs. That means that they may, at least temporarily, require government assistance like Unemployment Insurance or TANF. This raises costs at a time when the government is slashing benefits.

Political conservatives feel that the best way to balance the budget is to cut social services for the needy. Doing so, according to this philosophy, would force poor people to find jobs and become productive citizens. Critics point out that most social service entitlements go to children, old people, and the disabled–populations we typically excuse from joining the job market. Most of the rest go to households where individuals are already working at low wage jobs. Cutting benefits for these groups would be devastating.

Political liberals believe that cuts should be made in Defense spending while taxes on the wealthy should be increased. Critics argue that raising taxes on the wealthy would disincentivise investment and cause the economy to slow.

Some suggest doing nothing about the deficit. Critics, however, point out that increasing deficits leads to increasing debt. Eventually, those holding our debt, bondholders, will insist on higher interest as the debt becomes more risky. This will cost taxpayers and impact the money available for future benefits.

Regardless of where you stand politically, decisions with regard to the budget will have costs associated with it. Someone will have to pay those costs. How do we decide who pays? Balancing the budget is not nearly as simple as it seems.

Footnotes and Unlinked Sources

- There is some confusion about this commission. The confusion is in the name, DOGE or Department of Government Efficiency. That’s a bit confusing because the body, which consists of Elon Musk and Vivek Ramaswamy, is not really a “department” in the true or legal sense of the word. According to U.S. law, government departments cannot be made out of thin air because the President says so. It has to be approved and funded through congress, and the department head must be approved with the advice and consent of the Senate. So far, those things have not yet happened. So, the DOGE is at best an advisory committee for the President Elect. ↩︎

- These qualifying ages (or FRA for Full Retirement Age) are subject to change. For instance, the FRA for Social Security used to be 65 years old. That was changed in 1980s. Most of you reading this explainer must now wait until you are 67 before you can claim the full benefits from retirement. There is currently a movement for raising the Social Security FRA again to age 70. How long do you want to work? ↩︎

- You should note that Education also seems to constitute a big chunk of federal spending. This is unusual. Usually the Education wedge is much smaller. In this case, however, I’m using the 2022 budget which had approved large sums of money to help support schools during the pandemic. These were called ESSER funds. They have since expired. The current budget is just over $240 Billion. Most of that goes to student aid. ↩︎

- I might point out, we are not currently at war with anyone. ↩︎

- It was actually a $435 hammer. The figure was inflated through playing telephone in the media. But in reality, it was only a $15 hammer. ↩︎

- Means tested programs are programs that you must qualify for due to low income ↩︎

- In this case, the Welfare Queen was a real woman named Linda Taylor, who really did abuse the welfare system, then called AFDC (Aid to Families with Dependent Children. Reagan is often criticized for using Linda Taylor to stereotype all poor women of color as welfare cheats. Linda Taylor was not a typical welfare recipient. Most people on AFDC used it as intended as a temporary stopgap to poverty. ↩︎