On the Fed and Monetary Independence

Curriculum Specifications

- Courses: Economics, U.S. Government

- Educational Level: High School, High School Honors, Introductory College Level

- Reading Level: 9th Grade

- Reading Time: 18 minutes

Introduction

When the President of the United States is running for office, he makes a lot of promises about what he’s1 going to do to improve the economy. Oftentimes, when people vote, they are making a statement about their satisfaction, or lack thereof, of the state of the economy. The presidential candidate offers a slate of ideas for fixing the economy if it is perceived that times are hard. Or, the candidate may present plans for keeping the economy strong, or even building on a positive economy. To be fair, it’s been a long time since we’ve experienced the latter condition.

When someone gets elected, they are expected to put their economic policy into effect. Assuming the president can get his agenda passed through Congress (which isn’t always a given), what we find is that his policies often have very little impact on the larger economy.2 Even now, with our current president’s very extreme tariff policy, the impacts, both good and bad, have been underwhelming.3

Now, I don’t want to get into the details on this, because that would stray from the theme of this post. However, it is important for the student of economics to understand that Fiscal Policy, spending by the government, is rarely so dramatic as to have a noticeable impact on the larger economy.4 In economic terms, Monetary Policy, or the decisions made by central banks, is far more influential than anything a sitting president can do under normal circumstances. In the United States, monetary policy is run through the Federal Reserve Bank.

So, here’s the underlying tension. Some of the folks who make decisions at the Federal Reserve Bank are political appointees. In other words, they are nominated by the President, and approved by the Senate. Others are not. Those who are appointed, once they have their positions, can act independently of the President’s wishes. The President may want to stimulate the economy, in other words, get the economy to speed up, but the leaders of the Federal Reserve may decide to slow the economy down. In that case, monetary policy will be set to slow the economy down, and if all goes as planned, the economy will slow despite all of the President’s desires to the contrary.

Well, that doesn’t sound fair! After all, the President is elected. If people are dissatisfied with the economy, they can vote him out! Shouldn’t the President have the final say? After all, he’s the one who will be held accountable.

There’s the conflict. The President runs on what he or she is going to do for the economy. They are elected based on the economy. Their re-election largely depends on the state of the economy. And yet, the institution with the most influence over the economy operates independently of the President’s wishes.

The justification for this is that there is no rule mandating that the President have any background at all in economics. Furthermore, even if the President has a solid economic background, the his or her decisions may be influenced by factors having nothing to do with the health of the economy. A president may be inclined to make decisions for political expediency, poll numbers, electoral prospects, policy goals, rather than on what is best for the economy overall. The things he or she may want to do may have more to do with the president’s political ambitions than the economic interests of the whole country. Let’s take a closer look at the Federal Reserve, what it is, why we have one, and what it does.

Historical Background

Oh, Jeez! The freakin’ historical background. Why are you such a nerd?

You know it’s coming and you know you love it.

You see, there was a time when the Federal Reserve did not exist, and the results were…mixed at best.

The reality is that the United States has always had a skeptical relationship with the notion of central banks. Upon the founding of the country, Alexander Hamilton was a huge proponent of a central bank in order to get the nation’s totally screwed finances in order, help finance national development, and set the United States up to compete with advanced powers. And yes, he was also interested in paying off speculating bond-holders.5 After significant prodding, American founding legislators created the First Bank of the United States in 1791 with a temporary charter. A few years after that charter was allowed to expire, the United States found itself embroiled in the war of 1812 that left it financially shattered. The legislature then chartered the Second Bank of the United States in 1816.

During this time the United States experienced significant economic growth. A great deal of this growth was possible because of the stable finances vouched by the First and Second Banks. Yet Americans remained skeptical, and not without good reason. The Second Bank had a history of mismanagement, self-dealing, and fraud that hurt its reputation and exacerbated American’s distrust of bankers.

One noteworthy critic is said to have exclaimed about the bank elite, “You are a den of vipers and thieves. I have determined to rout you out, and by the Eternal, I will rout you out.” Unfortunately for the Second Bank, that critic was none other than President Andrew Jackson…and the bank’s charter was up for renewal. Not enough legislators voted to renew the charter to overturn Jackson’s veto, and that was the end of central banking in the United States for over seventy-five years.

Instead of a single bank, the United States had hundreds of private banks all doing their own thing and, get this, issuing their own paper currency. There was no real unifying financial institution outside of maybe the U.S. Treasury.

Wow! That’s crazy. Like there were all kinds of different dollars floating around?

Not quite. Dollars were issued in coins. Paper currency was issued by banks. So every dollar in paper currency had a notation somewhere along the lines of, “Andoscia Bank of Chattanooga Note.” Presumably, this banknote was backed by gold. Theoretically, you could take this Andoscia Bank of Chattanooga Note to the the Andoscia Bank of Chattanooga and turn it in for the face value in gold. But you probably won’t. So banks often felt safe issuing more paper currency than they actually had in gold. That, and some banks had better reputations than others. If you had a $5 note from Andoscia Bank, and nobody ever heard of Andoscia Bank, you may not be able to exchange it for the full value of the note.6 If the Andoscia Bank went out of business and you were holding thousands of dollars in Andoscia Bank Notes, you now had a bunch of fancy looking toilet paper. That’s all it was worth.

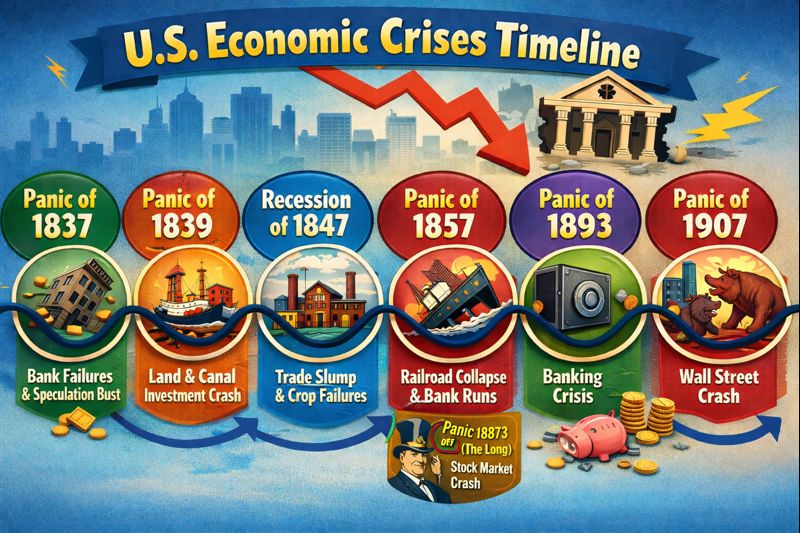

So, you can imagine how this led to currency speculation, risky investment, a lack of communication between financial institutions, and businesses willing to take advantage of that. Many of these banks over invested in the latest and hottest technology at the time–railroads and consequently got “railroaded.” Those who invested and had savings in those banks lost everything. This encouraged bank runs and “panics” during economic downturns that even caused the collapse of well-run banks and businesses. These panics happened a lot.

These were all major financial fiascoes that hurt millions of people. And frankly, even when things were going well overall, there were minor fiascoes that were also devastating at a local or regional level. The government did try to stabilize things with a couple of National Banking Acts during the Civil War. These were intended to provide some central accountability, but they did not go far enough. American finance was a mess despite the fact that a great deal of wealth was being created for the wealthiest Americans.

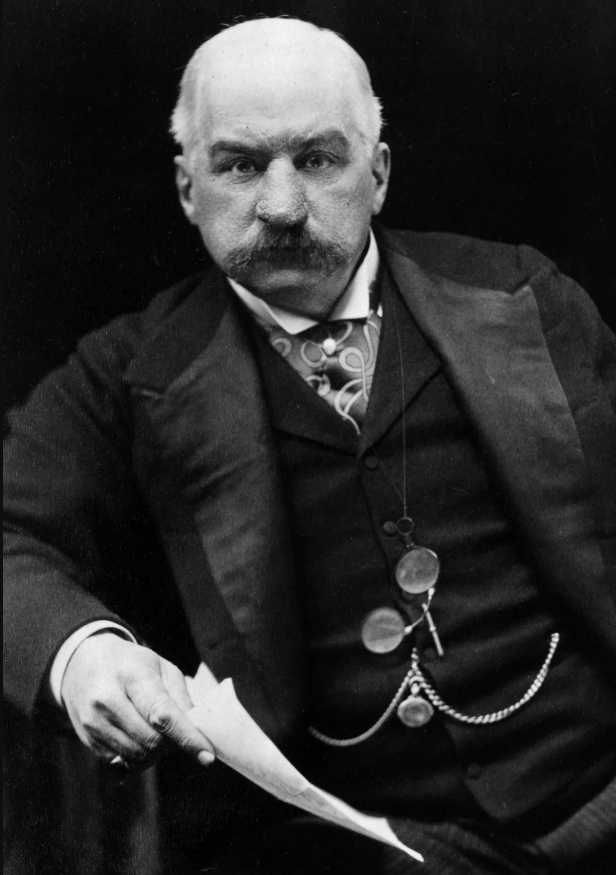

Among the biggest benefactors of this system was J. P. Morgan. This guy plays a huge role in the formation of the Federal Reserve Bank.

I’ve heard that name.

If you’ve heard of Morgan Stanley and J. P. Morgan Advisors, he’s their daddy. At least one of them.

Here’s the thing. In 1907 the fit really hit the shan financially speaking. That year a couple investors, F. Augustus Heinze, and Charles W. Morse, decided that they wanted control of a company called United Copper. They leveraged a lot of debt to do so. When their scheme failed, they were ruined. Furthermore, all the investors tied to them were also suspect. Investors started pulling out of anything that had to do with Heinze and Morse. Soon, other financial institutions were in trouble, including the Knickerbocker Trust Company. Other investors and investment banks tried to provide liquidity, but the panic was too fast and too far reaching to keep up, and the risk was too great.

J. P. Morgan was the most powerful financier of his time, but even he wasn’t able to bail out this mess on his own. He invited other major investors to a meeting, literally locked them in his private library and would not allow them to leave until they agreed to put up the money to bail the U.S. financial market out. This gambit worked, but it left a lot of Americans, including major investors, uneasy that the stability of the U.S. financial markets rest on what amounted to a kidnapping scheme. In the meantime, the Stock Market lost almost 50% of its value, factory production plummeted over 15% and U.S. GNP fell over 10%. And the only way out was to kidnap major investors and force them to bail the system out.

Yeah, that’s pretty deep!

Yeah. So a fella named Senator Richard Aldrich headed up the National Monetary Commission, also known as the Aldrich Commission, to study ways to keep this kind of thing from happening again. After studying other central banks, like the Bank of England, Aldrich brought some bankers to Jeckyll Island off the coast of Georgia to draw up a new central bank. They then lobbied for monetary reform based on their model. The result was what is now the Federal Reserve.

The Federal Reserve

Advocates for this new Federal Reserve had to balance two problems. First, Americans didn’t like bankers and they didn’t trust Wall Street investors. I know, right! On the other hand, they didn’t trust Washington insiders either. They did not want the government to be able to control financial decisions, but they also didn’t want a bunch of investors locked in a library to decide which businesses survived and which one’s didn’t during times of crisis. So, they wanted to create a system that was accountable to our elected leaders, but operated independently of political interests. That’s a pretty big ask.

The Federal Reserve Bank is divided into twelve regional banks. Federally chartered banks are required to be members of the Federal Reserve System. State Chartered banks are not, but may choose to be. Each regional bank is responsible for overseeing the member banks in its particular region. The incentives for participating are pretty strong. The Fed organizes check clearing, electronic payments, and interbank transfers. Member banks can thus make these transactions faster and more efficiently. Fed Regional Banks also gather a lot of economic data and can respond to that data quickly, helping member banks avoid runs, and access liquidity7 when they need it. The Fed also serves as a lender of last resort to banks. Participation in the Federal Reserve also makes investors more comfortable and more willing to invest in a member bank. On the other hand, member banks pretty much have to do what the Federal Reserve tells them to do and are subject to the Fed’s regulatory mechanisms.

The Federal Reserve is governed by a Board of Governors. This is where the government and the bank overlap. The seven “Governors” are appointed by the President and approved by the Senate. However, they serve for fourteen years. This gives each Governor independence from the political influence of the President, because once approved they are on the board beyond the President’s term unless they can be removed for cause.8

The Chairman of the Federal Reserve and the two vice chairs are also nominated by the President and approved by the Senate, but their leadership is restricted to four year, renewable terms. If the President does not like the Fed Chairman, he can always wait out the four year term and simply not nominate him again. But that doesn’t get rid of the Chairman. The former chairman remains on the board for what’s left of their fourteen year term. This further entrenches the Chair’s independence and provides continuity on the board.

The Federal Open Market Committee (FOMC) is responsible for that Monetary Policy I was talking about above. This is the meat of how the Federal Reserve regulates the economy.9 The FOMC has twelve voting members. The seven members of the Board of Governors and the President of the New York Federal Reserve Bank are permanent members of the committee. Four presidents from the remaining eleven regional banks serve on an annually rotating basis. This means that no single group can dominate the committee. The political appointees do not have the final say. Again, this further entrenches independence.

I don’t want to get into the weeds of how the FOMC regulates the economy. That’s beyond the scope of this lecture.

Thank God!

Anyway, suffice it to say that the FOMC sets the parameters that either incentivizes investment, Expansionary Monetary Policy, or saving, Contractionary Monetary Policy. Expansionary Monetary Policy, or Loose Monetary Policy is used during times of recession or weak economic markets. The goal is to boost demand and stimulate production. Contractionary Monetary Policy or Tight Monetary Policy is used during periods of inflation. The strategies used are indirect. It’s important to note that the FOMC does not have the power to force anyone to either save or invest. It functions by incentivizing certain economic behaviors. You can still borrow money when the interest rates are high…it will just cost you more, so you are less inclined to do it.

Monetary policy has become the most powerful tool for stabilizing the economy. The technocrats at the Federal Reserve have become really good at making the necessary adjustments to economic conditions. They are able to do this because they have access to the best, most up to date data on economic trends, and they have powerful economic theories and models by which to drive their decision making. That’s not to say the fed is perfect and never makes a mistake. But over the years, it has become a much more effective and efficient instrument.

The proof is in the pudding…

What exactly does that mean?

I’m really not sure, but let’s not digress.

The proof is in the pudding. Between the fall of the Second Bank of the United States and the creation of the Federal Reserve System, we had at least seven major panics and recessions. A few of these, the Long Depression, the Panic of 1837, and the Panic of 1893, lasted for years with no real mechanisms for dealing with them.

Since the establishment of the Federal Reserve, the number of major recessions has declined to just two, the Great Depression10 and the Great Recession. There have been many minor recessions, but they tend not to last very long because the Fed has learned how to respond.

We saw this just a few years ago during the economic crises caused by the COVID Pandemic.11 In 2020, when the economy was essentially shut down to contain the virus, the Fed went into action to keep the economy from completely collapsing. It used Expansionary Monetary Policy to make it very easy for businesses to get access to the credit they needed to keep afloat, and to help states fund the debt they needed to take care of their citizens. Once the health crisis was resolved, these interventions expedited people getting back to work and spending money.

Unfortunately, people were in a position to spend money much more quickly than there was stuff being produced and shipped to spend money on. This caused a period of high inflation. The Federal Reserve then shifted gears and instituted Contractionary Monetary Policy to contain inflation. When they did this there was a great deal of fear that in doing so, they would cause a “Double Dip Recession.” Some economists, like Larry Summers, even believed that such a recession was necessary to get rid of the inflation. The Fed, however, was much more careful in tightening monetary policy. Fed Chairman Jerome Powell expressed the goal was to create a “soft landing” for the economy. In other words, he wanted to bring down inflation without causing a recession.

It worked. Inflation dropped from 9.1% in June 2022 to 2.4%12 in September 2024. Inflation is currently around 2.7%.13 Fortunately, the Fed was able to use the data it had, combined with the expertise of its staff and leadership, to navigate this very difficult economic environment. It could do this without having to carry the burden of political expediency. Powell did appear before the Senate Finance Committee many times to keep our elected officials informed. There was political accountability, but not political interference.

The Importance of Fed Independence

Okay. I get it. They know what they are doing. But shouldn’t the President have some say?

The President can certainly make suggestions. If those suggestions are based on sound economic policy, then the Fed would be well advised to take the President’s suggestions into consideration. However, the decisions Presidents and other elected officials make are often influenced, at least in part, to political expediency. This is especially true around election time.

We have an historical example of what can happen when Presidents push the Fed into making politically expedient decisions.

Of course you do.

Back in 1970 the Fed became concerned because they started noticing indication of rising inflation. They were thinking it was time to institute that Contractionary Monetary Policy I mentioned above.

Here’s the problem. Contractionary Policy is really unpopular. People don’t like it when you make it harder for them to get money. The President, Richard Nixon, was in a bind. He had won the 1968 election, but it was a squeaker! Only .7% of the electorate favored him over his closest rival, Hubert Humphrey…and Hubert Humphrey was, well, a Hubert! Nixon knew his administration was on a tightrope. He needed an edge for the next election so he put the pressure on the Fed Chairman, Arthur Burns, to push for Expansionary Monetary Policy leading up to the 1972 election.

Burns tried to talk him down, and warned him that he was risking increased inflation. Nixon is reported to have said, “I’ve never seen anybody beaten on inflation. I’ve seen many people beaten on unemployment.”14 Burns caved and pushed the Fed into ill-advised Expansionary Monetary Policy.

It worked! The economy picked up and Nixon won in one of the biggest electoral landslides in history!

Wow! Cool!

Not cool. Shortly thereafter, inflation spiked and remained a problem for the next ten years.15 The seventies experienced a period known as Stagflation, in which high inflation was exacerbated by high unemployment. This is a real problem for the Federal Reserve16.

This crisis was only resolved when the Fed, under the leadership of Paul Volker walloped the economy with brutal contractionary policy in the early 1980s. Americans were forced to endure a deep recession as a result. This recession lasted until inflation came down. At that point, the Fed reversed its policy, opened up the loose money spigot, and ended the recession.

In the history books, this is a bit of a footnote known as the Volker Shock. For those of us who experienced it, however, times were very difficult. All so Tricky Dick could get re-elected…only to resign a couple years later because of the other shady stuff he did to get re-elected.17

Conclusion

The Federal Reserve Bank is not a perfect institution. It makes mistakes. It misses things. It is run by people and people are often flawed.

Democratic politics is notably chaotic and often raucous. A solid democratic society can handle this kind of political push and pull. For those of us who are into politics, the kind of uncertainty that comes from democratic contests is exciting. It’s why we love politics. Economies, however, prefer stability and predictability. Investors don’t want to invest if they think the conditions in which they are placing their investments can change on the whims of politics. The existence of an independent central bank that guides the economy through indirect means may be frustrating to those with a political agenda, but it is assuring to the investor.

If monetary policy should fall into the political realm, expect economic instability as a result.

Footnotes

- So far, it has always been a he, though a few women have run and made similar promises. I look forward to the day when I can say he/she. Maybe even he/she/they. ↩︎

- We’ve touched on this before in other economic and current event blog posts. A good example is President Obama’s and the Democrat’s stimulus bill in 2009, intended to end the Great Recession. The American Recovery and Reinvestment Act (ARRA) spent over $800 billion. There is some evidence that it was at least in part responsible for ending the recession, but it was not enough to spark a vibrant recovery. The economy remained sluggish for a couple of years before anything even resembling a recovery could be perceived. This cost Obama and the Democrats dearly in the 2010 midterms. Many economists at the time warned that ARRA was much to small, and needed to be at least $2 trillion. ↩︎

- Trump’s tariffs have been the most extreme in almost a hundred years. Advocates say that his tariffs will restore American manufacturing and, ultimately bring prices down. That has yet to happen. Critics say that tariffs will slow the economy and cause inflation to surge. Some critics have suggested that Trump’s tariffs will be catastrophic. Well, that hasn’t happened either. It does look like the economy is slowing, but not to the point of recession. Thus far, inflation has remained stable. So far! ↩︎

- A notable example is Franklin Roosevelt’s New Deal in the 1930’s and 40’s. Tremendous resources were used to get the United States back on track. Comparing the New Deal to the American Recovery and Reinvestment Act is informative. ARRA cost the equivalent of 5.7% of the U.S. economy, whereas the New Deal was the cost equivalent of around 40% of GDP, seven times the Obama stimulus. Even at that, the Great Depression lasted over ten years. It took the massive spending and economic interventions of World War II, on top of the New Deal, to end the Great Depression. Under normal fiscal circumstances, no administration has access to that much resources. ↩︎

- For a strong and accessible description of Hamilton’s goals, see Hogeland, William. 2024. The Hamilton Scheme: An Epic Tale of Money and Power in the American Founding. New York: Farrar, Straus and Giroux. ↩︎

- This problem was later resolved with the National Banking Acts 1863 and 1864 ↩︎

- Liquidity means easily available cash. ↩︎

- Removing Chairman Powell with cause seems to be what the President is trying to do. ↩︎

- It’s important to understand what I mean by “regulates the economy.” The Federal Reserve does not run the economy, so to speak. That would be too much power, and it would also be technically impossible to do. Only bad stuff can come from that. Instead, through the FOMC, the Federal Reserve creates the monetary environment by which banks and investors make financial decisions. In other words, it sets up the economic playing field, the government sets the rules, and private actors decide how they are going to play. Nobody decides the outcomes. ↩︎

- I would note another important element helping stabilize the economy, John Maynard Keynes’ General Theory. Keynes’ The General Theory of Employment, Interest and Money was published in 1936. It wasn’t in time to help with the Great Depression, but its emphasis on Demand Side Economics and deficit spending has been a powerful tool for helping policy makers make decisions. Unfortunately, Keynes was out of fashion when the Great Recession hit. Many economists point to the refusal of policy makers to use Keynesian strategies to stimulate the economy as the reason it lasted as long as it did. That’s a topic for another day. ↩︎

- I’m referencing both the recession and the consequent inflationary crisis. ↩︎

- The target inflation rate is ~2%. Why? Well, that’s a post for another day. ↩︎

- The increase may be attributed to current tariff and immigration policy, both of which is inflationary. ↩︎

- Nixon may have never seen anyone beat on inflation, but we have. President Biden’s loss in 2024 is largely attributed to the high inflation experienced during his presidency. Currently, President Trump is being criticized for continued high prices. ↩︎

- Contrary to our current President’s claims, this was a much more severe inflationary period than the one we just experienced, with inflation reaching almost 15% by 1980. ↩︎

- Again, I’m avoiding the complexities here. Maybe I’ll do a later post on Fed conundrums. ↩︎

- I’m talking about Watergate. ↩︎